Editor: Are you ready for the funds needed for your life in the old age? Xie Shiying, the 65-year-old depositor, has been depositing shares since she was 45 years old and can earn about 2 million yuan in dividends every year so far. He emphasized th...

Editor: Are you ready for the funds needed for your life in the old age? Xie Shiying, the 65-year-old depositor, has been depositing shares since she was 45 years old and can earn about 2 million yuan in dividends every year so far. He emphasized that it is not difficult to deposit stocks, there is only one principle: use the price to buy a good company, how to use deposit stocks to create a long-term passive income for yourself?

What plans do you have in the second half of your life? I can’t recognize that most of the things we want to do require stable and sufficient financial support when we want to do. The income from continuous income makes people feel safe and ensures that our old age can be independent and do not need to rely on others.

In recent years, the security fund has been in a timely manner, making office workers worried that their pension is in danger. With the average life expectancy, the more time you spend in your life without making money or spending only. After retirement, there is less active income from work. Where does the money come from? The "passive income" created by oneself will be an important source of income.

65-year-old Gao Master, Xie Shiying, retired professor, was like most people at a young age, and believed that money management is equivalent to saving money. However, as bank interest rates are decreasing year by year, fixed-deposit investment returns can no longer resist inflation. At the age of 45, he began to "storage stocks": he did not aim at making a difference in the price, but chose a fixed dividend every year with a selected investment target. Accumulated dividend income can be purchased into new stocks. He now holds more than 1,000 stocks with an annual dividend of about 2 million yuan. Not only is it enough to pay for life sales, but it also makes every effort to donate 1/10 for charity.

How to choose a company with good dividends every year?Some people who like to select stocks from the stock market average, web, K-line and other technical analysis. Xie Shiying believes that stockholders only need to remember one major principle: buy stocks in good companies with reasonable prices. The stocks of good companies are worth holding for a long time, and don’t sell them easily with the ups and downs of the market. "When the stock god Buffett didn't focus on the market, he became the richest man in the world. Why do we ordinary people work so hard?" he said jokingly.

He metaphorically, saving stocks is like building a coffee garden. Coffee trees with good quality can harvest coffee beans every year. The seedlings bought with the cash obtained from selling coffee beans. Over time, more and more coffee trees are added and there are huge harvests every year. However, with more than 1,700 files on the Taiwan Stock Exchange listed counter companies, how can novices in stocks pick up a solid and good coffee tree from them?

Xie Shiying pointed out that although he holds more than 1,000 stocks, the number of files is only about 25. Looking from a stable industry with a stable industry is one of the easiest channels to choose a good company. His first list of stocks, including Uni-President (1216), Centre (2002), Formosa Plastics (1301), Nanya (1303), etc., all conform to this principle.

He suggested that novices can start with the industry they are more familiar with when they start investing. Unfamiliar with a large number of industries, touch as little as possible. For example, he never bought airline stocks because airline stock prices are easily affected by short-term news. He is not easy to take action at the moment when he is popular in biotech stocks, 3D printing concept stocks, renewable energy stocks, and 5G concept stocks: "Don't buy unfamiliar industries, you don't have the ability to identify the company's business conditions, but it's bad." The company's evaluation of financial magazines and the shareholding ratio of supervisor Dong are also indicators to observe the company. Xie Shiying pointed out that if the shareholding ratio of Superintendent Dong is more than 10%, it means that the company has high centripetal force and the operating team has confidence in the company's prospects. Taking Yushan Gold (2884) as an example, the company's team is composed of professional managers and is often among the top in corporate evaluations. Moreover, Superintendent Dong's stable holdings and senior executives mostly use stocks as pensions, which is one of the "good coffee trees" that he thinks is worth holding for a long time.

Although you don’t need to watch the market every day, you still need to follow and grasp the company’s operating status for a long time. Every once in a while, Xie Shiying will go to the "Yahoo! Stock Market" website to confirm the profitability of his shares in the past four quarters. The gross profit margin and investment in each quarter are obvious at a glance. If the company's profit situation becomes worse, there is no need to rush to sell it, but pay close attention and find out the reasons. To evaluate whether "good students" are bad at the moment, or have become "bad students" in essence.

In addition to specific quantitative indicators such as acquisition, Xie Shiying also likes to use life observation as a quality indicator to judge the company's operating status. For example, when he held Yulong (2201) stock in the past, he would deliberately visit the sales outlets on holidays and ask how long it would take for the salesperson to buy a car? If the answer is not required, it means that the business is light and investors should be wary of it. On the contrary, if you still need to register for buying a car, it will show that the operating status is good, so you can rest assured.

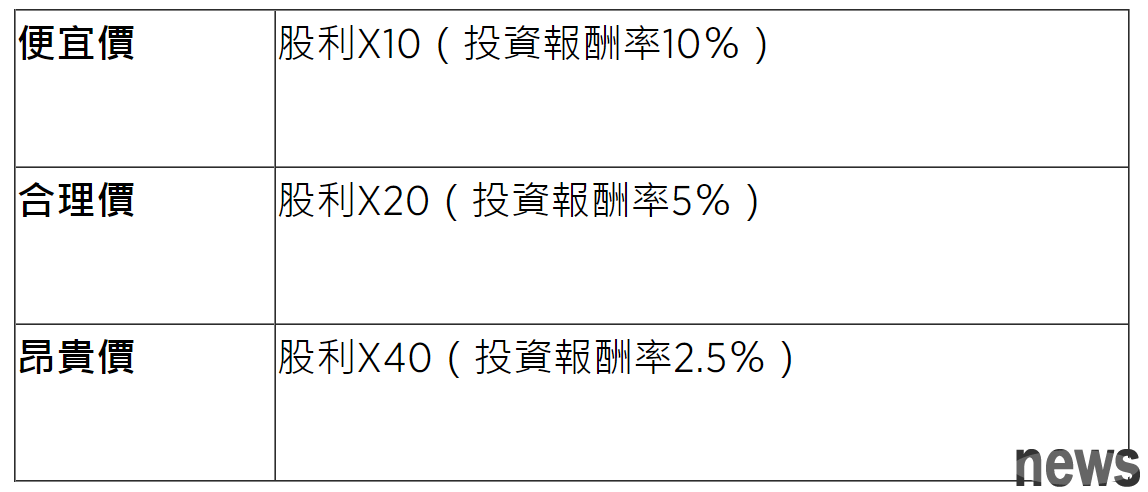

10, 20, and 40 principle: use the capital ratio to calculate the reasonable price for entryto find a good company. The next step is to buy stocks with the good price. How much is a good price? Xie Shiying has a set of stock calculation formulas of "10, 20, 40". A stock, if the dividends pre-allocated in that year are multiplied by the principal amount of 10, 20, and 40, it will result in 3 prices: cheap, reasonable, and expensive. When the price of a stock falls above a reasonable price or even exceeds the expensive price, it is not a good time for stockholders to enter the market (see Table 1).

Table 1: Stock calculation formula setting purchase timer

Taking the well-known Taiwan Electric Power (2330) as an example, in 2020, the cash dividend of Taiwan Electric Power distribution was 7.5 yuan per share, and its cheap price, reasonable price and expensive price are 75 yuan, 150 yuan and 300 yuan respectively.. In the second quarter of 2020, Taiwan Power's share price was about 325 yuan, divided by dividend income by holding cost, and the investment return rate was about 2.3%. From the perspective of stock deposits, this price has exceeded the high price, and the return on investment is naturally lower.

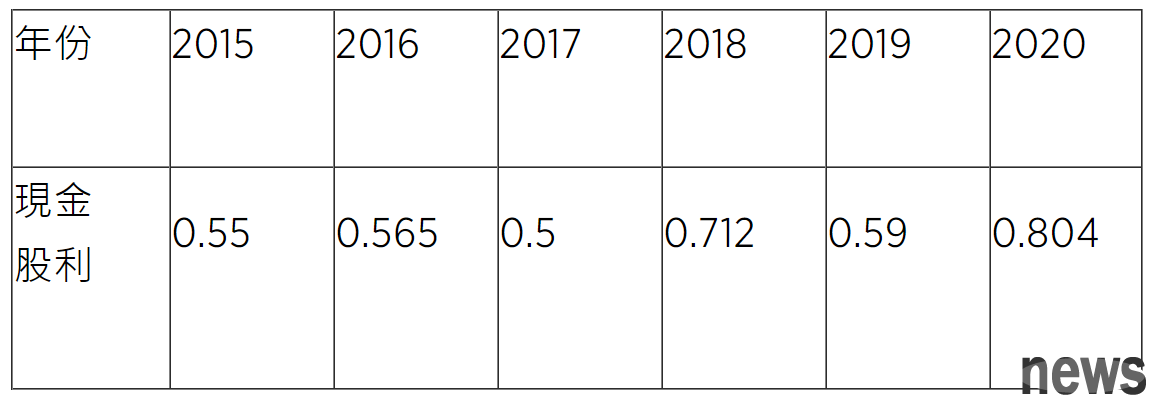

What if the stock price of a good company that Xinyao's has been unable to drop and cannot find a time to enter the market? "Don't worry about him, go buy another one!" Xie Shiying said that when the stock price of Longtou TECHNOLOG (2330) is too expensive, he will choose Telecom (2303). Although the latter's revenue is not as impressive as Taiwan Power, its operation has been stable over the past years, and cash dividends of RMB 0.5 to RMB 0.75 per share are allocated every year. In 2020, the cash dividend of Joint Stock Allocation was 0.804 yuan, and the stock price fell at a reasonable price of around 16 yuan, which is a tag that stockholders can consider holding (see Table 2).

Table 2: Telecom's cash dividend policy in recent years

*