Aunt Su, 60, passed away many years ago, and her children are busy at work. Recently, due to the epidemic, there is nothing to do at home. Under the introduction of the neighborhood, she wants to learn to use dating software for young people and suc...

Aunt Su, 60, passed away many years ago, and her children are busy at work. Recently, due to the epidemic, there is nothing to do at home. Under the introduction of the neighborhood, she wants to learn to use dating software for young people and successfully match "Mr. Lin" who was just divorced at the age of 55. Mr. Lin said that he had moved from Taiwan to Mainland before and was a science and technology manager and had no children with his ex-wife.

Add LINE chat, first give me a small amount of investmentAunt Su felt that Mr. Lin was trustworthy, and gradually took off his guards, and chatted with Mr. Lin. Mr. Lin had a lot of conversation with Aunt Su, which made Aunt Su, who had been alone for a long time, feel like he was treated and affirmed, and also believed that he had found the second trustworthy companion in his life.

Later, Mr. Lin discussed the "future of two people" with Aunt Su and explored Aunt Su's financial management situation, including no investment, several bank accounts, several credit cards, etc. Mr. Lin later recommended Aunt Su to download a certain APP, saying that this was his associate and hoped that Aunt Su could support him. Aunt Su invested money in that APP to buy virtual currency Taida coins, and after a small amount of investment, he really made a profit, and the money was really transferred to the head of the client.

Add to pay the whole thing. The other party disappeared. AfterMr. Lin advocated that Aunt Su would add to the code, and based on the grounds of "the future of two people", he hoped that Aunt Su would invest more money. Aunt Su not only uses deposits, applies for credit, lifts insurance, and even borrows money from friends. Unexpectedly, the virtual currency she invested was greatly damaged, and she couldn't get back the initial principal. Not long after, Mr. Lin disappeared, and even her LINE account was deleted. Aunt Su was surprised that she had "two losses in human finances."

The above is a real case. In recent years, not only has the risk of information and online investment has been rampant, but the risk of making friends during the epidemic has become even more serious. Some of the lonely Orange Generations made friends online. They originally thought they could find a partner who could complain to each other, but they did not expect that they would be instigated to invest in illegal financial products, such as virtual currency, overseas financial products, etc., and eventually lost their relationship and money.

The bank has blocked more than 60% of fake friendsAccording to the statistical data of the "Terminal Offer (Exchange) Payment Method" issued by the Police Department of the Ministry of the Interior, there were more than 500 million cases of "Fake Friendship (Investment and Enrollment and Enrollment)" in the first eight months of last year, accounting for 60% of the total cheating cases. The bank's data is not the same. Taipei Fubon Bank pointed out that 63% of the cases blocked by bank branches are investing or seeking marriage fees by fake friends.

Yuan Da Bank also provides a real case last year. At 2 p.m. on September 3 last year, a woman from Taichung City went to the Fengyuan Branch of Yuanda Bank and wanted to transfer US$10,000 (approximately NT$500,000) to overseas. The woman called her foreign boyfriend whom she met online. Because she was building a construction industry, she needed to pay taxes to execute the project bid and urgently needed assistance. Fortunately, the operator found something strange at a time and notified the police to arrive and prevent it.

Lin Zhi-chan, chairman of the Financial Evaluation Center, said that during the epidemic period, the Financial Services Specialty of the Review Center in 1988, the most common types of financial services were actually dating cheats. This started with "emotion" and ended with "investment cheats", which caused consumers to lose money in both financial situations.

Lin Zhiyan pointed out that victims of dating cheating have a tendency to rise in age. Usually, the victims are encouraged by the other party to buy financial goods through online dating. Most of the money they buy is virtual currency or overseas financial goods, and many of them are non-existent financial goods, which are cheated by using financial technology as a guise. Because the objects of the transaction are not financial institutions and the things they buy are not legal financial commodities in the country, the Financial Management Council and the Financial Review Center are helpless and can only be handed over to the Criminal Police Department for assistance.

Investment prevention "stop reading and listening"Bankers pointed out that criminals usually use facial books or other dating software to identify victims, reduce their vigilance through continuous interaction, and then use investment, gifts, loans, etc. to transfer the victims.

Lin Zhi-hyun, chairman of the Financial Evaluation Center, believes that consumers cannot just protect themselves, but should pay (Empowerment) and allow consumers to cultivate their self-responsibility and self-warning attitude. "When we buy milk, we will look at the shelf life. You have never heard of this at all. Then in Canada or Bermuda Islands, you think you can buy it. Don't you think it's strange? Is it hard to understand the content of the product? And how much money is, why don't you invest if you don't understand it well?"

Bankers remind that when the other party requests transfer of funds for any reason, they should remember the principle of "stop reading and listening": suspend payment, calm observation, and immediately call the financial institution or the Police Department 165 line to listen to what experts say, which can more effectively avoid the trap of dating cheating.

Dating Query Frequently Seeking 5 ModeStep 1: Gain a favorable impression

The Query Group will find targets through dating software, and use fake photos and fake information to establish character settings, so that you can get good impressions every day.

Step 2: Confirm financial

The association requires the other party to join the LINE to interrogate family and emotional status during the chat, and at the same time confirm the victim's economic ability.

Step 3: Guide investment

Test group reveals its sub-employment and investment profitability, advocates victims to download illegal APPs or web pages, and recommends that victims invest a small amount of money to try their skills.

Step 4: Small profits and big profits

At the beginning, the victims will make small profits, so that the victims will let go of their guards. When the victim receives the money they earn, he will not be suspected of being there. The snatching group will continue to advocate that the victims invest more money.

Step 5: Human evaporation

When the victim realizes that he is being cheated, the scammer group will disappear, be afraid of threats or ecstatic blackmail.

High age is more difficult to defend. First set up a trap for love and then rob your investment and financial investmentWill you be cheated because of your old age, dementia and poor judgment ability? Ding Jing, director of the Prevention Section of the Criminal Bureau, said that in fact, victims of trial cases have all ages. Those who are not high-age are particularly prone to being cheated. Many victims even learn to learn to play or practice smartly. However, analyzing the types of people with high ages who are prone to being chaotic, reconciliation, fake family friends and online dating, etc., which are based on "emotion", is indeed particularly easy to remove the toughness of defense, becoming the starting point of the challenge, and even becoming a fake investment challenge.

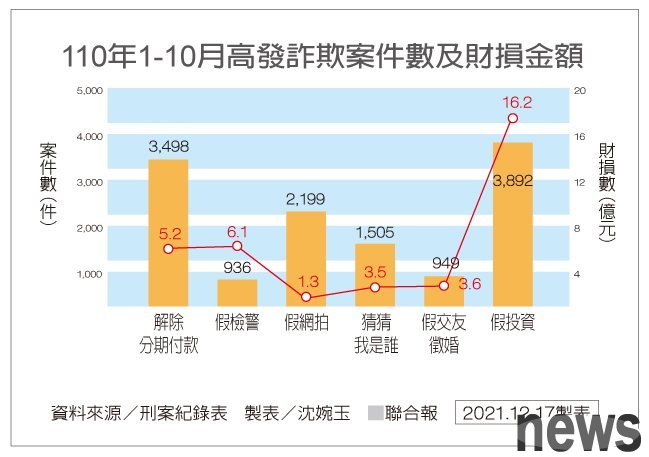

After the outbreak of the epidemic, the rate of public online and using digital tools has increased. The Criminal Bureau has determined that from January to October this year, the "false investment" type of fraud has increased significantly, and the amount of financial funds is also higher than other types of fraud. The second is to lift the installment payment criterion. However, further analyzing high-age victims over the age of 65 will be more likely to be deceived by "fake police" and "guess who I am".

Look at loneliness, ask about the relationship between warmth and traps, and the Criminal Bureau analyzed that elders are affected by the social atmosphere during the growth process, and are in awe of the government agencies, and are prone to being deceived by false alarms. As for the "Guess Who I am" technique, it is to call or contact LINE, pretend to be a nephew, child, nephew, etc. of the elderly, and they are hot and cold, and then they are entitled to illness or need money in urgent need of money, so they borrow money from the elderly and ask for money for redeem.

The boss usually misses relatives or is late, but actually lacks contact. The criminals catch this kind of mood, which makes the boss mistakenly think that he is in a good mood when he receives the call from the person he misses, so it is naturally difficult to distinguish the real identity of the caller.

The scavenger group strives for excellence, and also uses the weakness of the elders who have less contact with their friends, but also miss their friends and are somewhat lonely. They begin to extend various scavengers to make friends. Whether love or friendship is based on emotions, as long as the victims take advantage of the situation, they will eventually become borrowing money or fake investment.

Ding Jing said that of course there are still many people who really make friends, but if you are raising money, you should pay special attention. Don’t take advantage of it or invest in virtual currency, futures and other things you don’t know.

What should I do if I get cheated? Ding Jing said that the main payment channels for fraud are counter transfers and online transfers, both of which must be operated through the financial system, so the accounts involved can be found by tracing the crime flow, and tracing the source and trace the fraud groups and funders behind the scenes to intercept the amount of money that the victim was cheated and to fight crime. "The role of a financial institution is very important."

Intelligent defense: Use technology to detect and alertRecently, the Criminal Bureau and Beifu Silver cooperated with the "intelligent defense and strengthened guarantee" mechanism. The Criminal Bureau has compiled years of investigations accumulated by the fraud group, analyzed criminal phenomena and suspicious signs, and established intelligent models from both parties' information teams to establish a financial detection and detection and warning mechanism to strengthen the online crackdown on crime.