Chip manufacturer AMD held its first analyst day event in three years in New York on the 11th, at which it announced extremely optimistic financial expectations and market outlook. AMD said its annual profits will more than triple in the next three...

Chip manufacturer AMD held its first analyst day event in three years in New York on the 11th, at which it announced extremely optimistic financial expectations and market outlook. AMD said its annual profits will more than triple in the next three to five years, and annual revenue from its data center chip business is expected to reach $100 billion within five years.

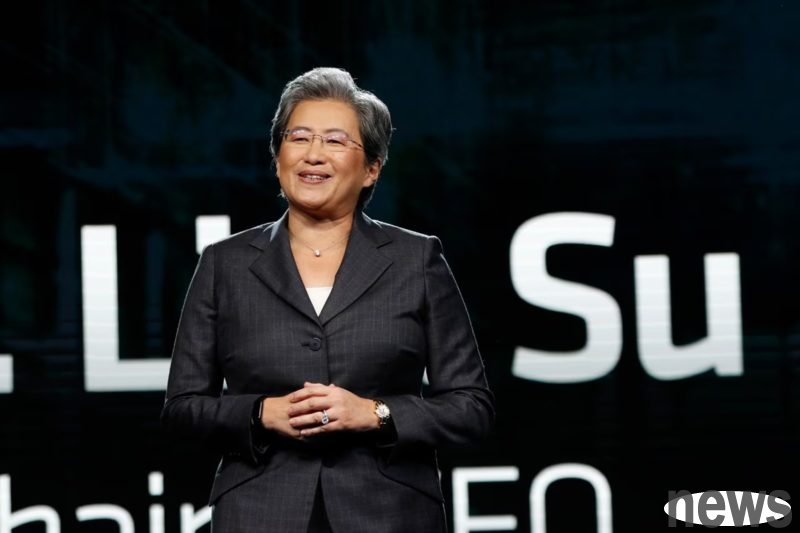

AMD CEO Lisa Su pointed out that the market size of data center chips is expected to grow to US$1 trillion by 2030. She emphasized that the artificial intelligence (AI) market demand covering AMD's general processors, network chips, and its professional AI chips will be the main driving force for the growth of this trillion-dollar figure. So she thinks it's an exciting market. There is no doubt that data centers are the biggest growth opportunity right now, and AMD is very well positioned.

AMD Chief Financial Officer Jean Hu pointed out that in the next three to five years, the company expects its entire business to grow by 35% annually, and the growth rate of the data center business will reach 60%. In terms of profit targets, AMD expects earnings per share (EPS) to grow to US$20 during the same three to five years.

It is worth noting that Jensen Huang, CEO of AMD’s main competitor NVIDIA (Nvidia), has stated that the broader AI infrastructure market will grow to US$3 trillion to US$4 trillion by 2030. Therefore, in order to seize the AI market share, AMD is actively planning new products and implementing strategic mergers and acquisitions. Among them, in terms of new generation AI chips and servers, AMD's next generation MI400 series AI chips are expected to be launched in 2026. This series will include multiple versions for scientific applications and generative AI design. At the same time, AMD also plans to launch a complete set of rack servers, similar to the GB200 NVL72 product sold by NVIDIA.

As for mergers and acquisitions to accelerate AI capabilities, Su Zifeng emphasized that AMD has established a "M&A machine" (M&A machine). Recently, the company has made several AI-related acquisitions in particular, including server builder ZT Systems and a series of smaller software companies. Especially this Monday, Supermicro announced the acquisition of MK1. Chief Strategy Officer Mat Hein said the purpose of the acquisition is to ensure that AMD has access to the appropriate software and talent needed to run AI applications. Therefore, the company will continue to make AI software tuck-ins.

Finally, AMD’s revenue forecast for the fourth quarter exceeded market expectations. Because market demand for AI chips has provided AMD executives with reasons to be optimistic, including the data center CPU business, which has also benefited from the substantial growth in AI-related spending.

Previously on October 6, Supermicro signed a lucrative multi-year agreement with OpenAI, which is expected to bring in tens of billions of dollars in revenue every year. While the deal is unlikely to shake rival NVIDIA's dominance in AI chip manufacturing, it is seen as a vote of confidence in AMD's chips. The market also expects that strong financial forecasts will help eliminate investor doubts about AMD's ability to compete for market share.

After the analyst day, AMD shares rose 4% in after-hours trading. Cumulatively, AMD's stock price has risen 16% since signing the agreement with OpenAI on October 6.