According to reports from the Huaer Street Journal, the trend of artificial intelligence (AI) has triggered the most expensive wave of foundational construction in history. In just three years, major technology companies' investment in AI data c...

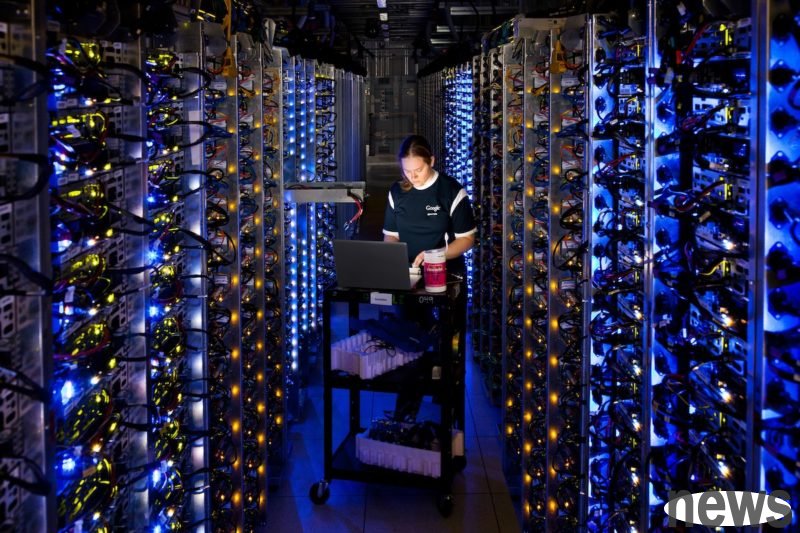

According to reports from the Huaer Street Journal, the trend of artificial intelligence (AI) has triggered the most expensive wave of foundational construction in history. In just three years, major technology companies' investment in AI data centers, chips and energy fields has exceeded the total cost of building an international highway system in the United States for a period of 40 years.

The report pointed out that a large amount of investment in the AI-based facility sector is causing trouble because market doubts about the return on AI's entertainment investment will be difficult. The report emphasizes that the cost of developing an AI model is extremely high, and reporting requires higher returns to prove that these expenses are reasonable.

The report quoted a market analyst saying that in 2023 and 2024, consumers and enterprises need to purchase AI products worth about US$80 billion during the life cycle of these chips and data centers. However, data center chips have limited service life, as the rapid development of AI technology will rapidly weaken its value. According to data research by analysts, most AI processors have only three to five years of effective service life.

For example, OpenAI executive director Sam Altman has promised that in the next few years, the company will pay an average of about $60 billion a year to Oracle for data center server-related services. In contrast, OpenAI is expected to receive only about $13 billion from paid users in 2025.

In addition, the analyst emphasized that the surge in investment in AI-based facilities represents that by 2030, the AI-based sector’s annual revenue needs to reach $2 trillion before it has the opportunity to receive a return. For reference, this number not only exceeds the total revenue of Amazon, Apple, Alphabet, Microsoft, Meta and NVIDIA in 2024, but is more than five times the global subscription software market size.

In addition, Bloomberg also reported that the acquisition of AI companies is achieving rapid growth. OpenAI expects that its operating income will increase to US$1.27 billion in 2025, twice as high as before. Its rival Anthropic has earned more than $5 billion in annual revenue. However, these revenue figures are still comparable to the future increase in basic facility costs. It is estimated that between 2025 and 2028, global data center investment will reach US$2.9 trillion, a scale roughly equivalent to France's one-year total domestic production value (GDP).